Our Clients

By understanding our clients' needs, we provide tailored investment solutions to help them achieve their financial goals.

By understanding our clients' needs, we provide tailored investment solutions to help them achieve their financial goals.

for Lasting Value

IGIS Asset Management manages assets for over 200 major domestic institutional investors, including pension funds, mutual aid associations, insurance companies, and public institutions. Through our overseas offices and local networks, we are also expanding partnerships with global investors seeking new investment opportunities. The outstanding investment performance of our institutional clients directly and indirectly impacts the financial well-being of millions of pension beneficiaries and investors, making it a goal we are committed to achieving.

Commingled Funds

with Strong Performance

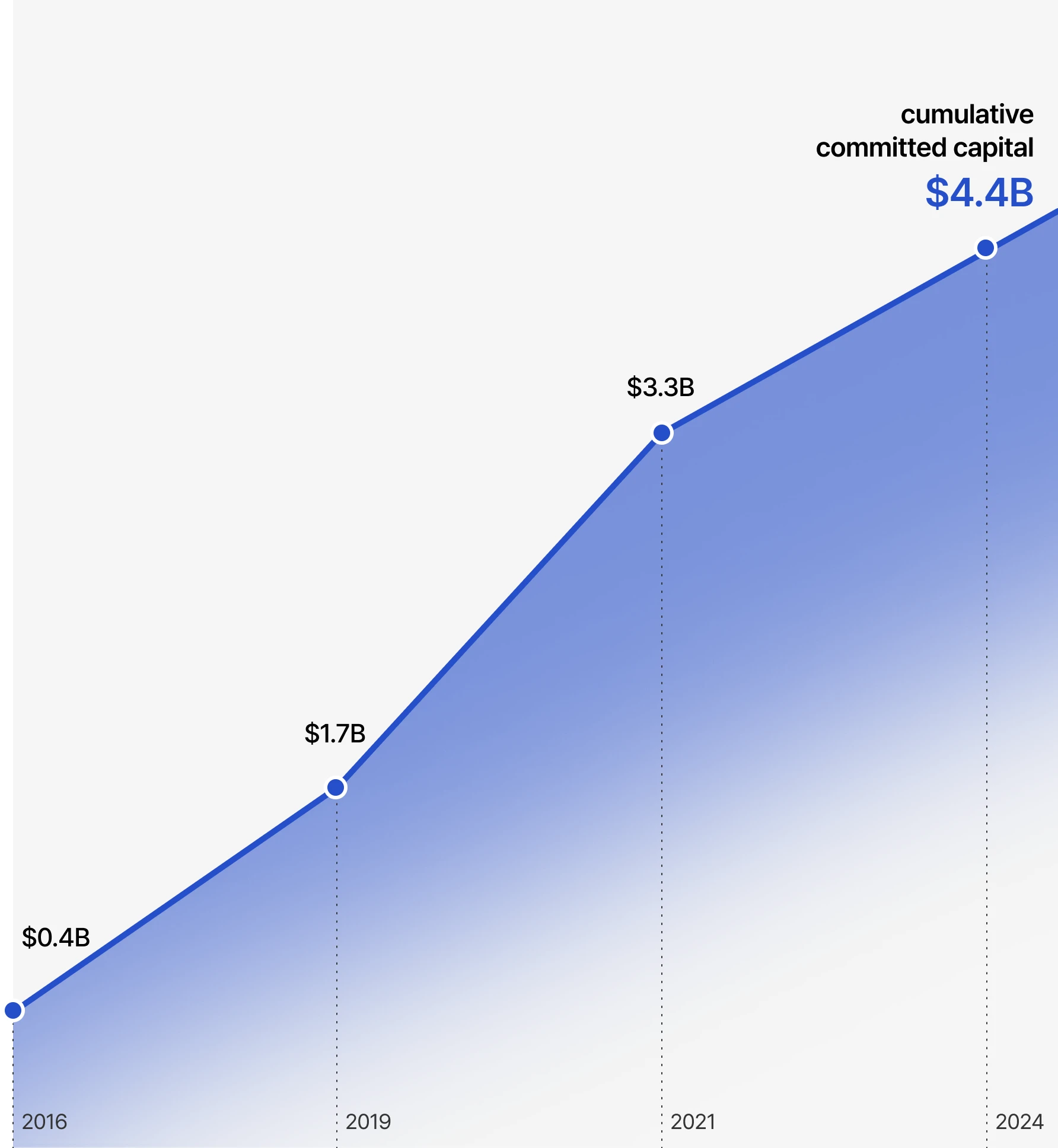

A commingled fund is one where institutional investors entrust an asset management firm with the selection and management of investments based on predefined guidelines. The size of these funds reflects the trust institutional investors place in an asset manager. Since launching our first commingled fund in 2016, we have experienced remarkable growth. By 2024, the cumulative committed capital has reached USD 4.4 billion, marking a 11-fold increase in just eight years. This achievement is a result of systematic management, professional investment expertise, and strong client trust. With expertise spanning real estate, logistics, housing, data centers, and NPLs, we combine deep industry knowledge with dedicated teams to ensure long-term growth and stability for our clients’ assets. This track record of trust and performance continues to create new opportunities, reinforcing a virtuous cycle of success.

and deliver target returns. We are committed to becoming

the most successful and valuable component of

our institutional investors' portfolio strategies.”

IGIS Asset Management Co-CEO Young-Goo (Andie) Kang